The insurance industry, historically characterized by paper-laden processes and manual assessments, is undergoing a profound technological metamorphosis. At the forefront of this revolution are Unmanned Aerial Vehicles (UAVs), commonly known as drones, coupled with sophisticated remote sensing technologies. This powerful synergy is not merely an incremental improvement but a fundamental paradigm shift in how property and casualty insurers approach claims adjusting and damage assessment, moving the entire process from the ground to the sky.

For decades, the property claims process has followed a largely unchanged script. Following a catastrophic event like a hurricane, hail storm, or wildfire, an army of human adjusters would descend upon the affected area. Their task was monumental: to visually inspect, measure, and document damage for hundreds or thousands of properties, often while navigating dangerous conditions, inaccessible terrain, and distressed policyholders. This method was not only time-consuming and labor-intensive but also inherently risky and subject to human error and inconsistency. The logistical challenges often led to significant delays in claim settlements, exacerbating the financial and emotional strain on homeowners and businesses.

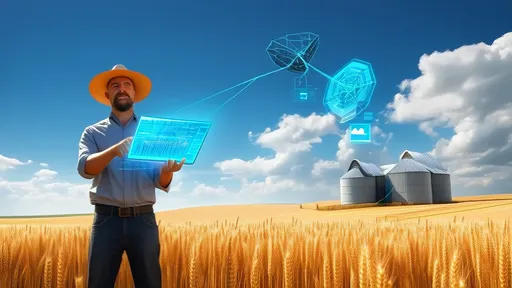

The advent of commercial drone technology provided the first glimpse of a better way. Initially, drones were seen as little more than flying cameras, a novel tool to get a bird's-eye view of a damaged roof. However, the true revolution began when these UAVs were integrated with advanced remote sensing payloads that far surpassed standard RGB cameras. Insurers and specialized service providers began deploying drones equipped with high-resolution optical sensors, thermal imaging cameras, LiDAR (Light Detection and Ranging) scanners, and multispectral sensors. Each of these technologies unlocks a different layer of data, painting a comprehensive and objective picture of damage that is invisible to the naked eye.

High-resolution photography and videography remain the foundational application. Drones can safely capture detailed imagery of every elevation of a structure, especially roofs, which are often the most vulnerable and hazardous to inspect. These images can be stitched together using photogrammetry software to create precise orthomosaics (2D maps) and detailed 3D models of a property. These models allow adjusters to take accurate measurements of roof areas, count shingles, and identify damage like missing tiles, granule loss, or punctures from a safe distance, all without ever setting foot on a ladder.

The integration of thermal imaging cameras has been a game-changer for detecting hidden damage. Following a fire or a water loss event, moisture intrusion within walls or under roofing materials can lead to mold and structural decay if not identified and remediated quickly. Thermal cameras detect temperature variations caused by evaporative cooling from moisture, clearly outlining damp areas that require attention. Similarly, thermal scans can identify heat leaks from poor insulation or pinpoint electrical faults within walls, preventing future losses.

Perhaps the most powerful remote sensing technology being deployed is LiDAR. By emitting laser pulses and measuring the time it takes for them to return, LiDAR sensors can generate extremely precise, point-cloud representations of structures and their surroundings. This is particularly valuable for assessing volumetric damage, such as the precise amount of debris after a collapse, or for creating engineering-grade models to analyze structural integrity. Following large-scale catastrophes, LiDAR-equipped drones can rapidly map entire neighborhoods, providing insurers with accurate data to quantify exposure and triage claims based on severity.

The raw data captured by these sensors is immense, but its true value is unlocked through powerful data analytics platforms and artificial intelligence. The terabytes of imagery, thermal data, and LiDAR point clouds are uploaded to cloud-based processing software. Here, algorithms powered by machine learning go to work. They can be trained to automatically flag anomalies, classify different types of damage (e.g., hail spatter vs. blistering on a roof), and even generate preliminary estimates for repair costs. This shift from manual inspection to automated analysis drastically reduces processing time and introduces a new level of objectivity, minimizing disputes between policyholders and insurers.

The benefits of this technological convergence are multi-faceted and transformative. The most immediate impact is on operational efficiency. A drone can complete a detailed inspection of a property in a matter of minutes, a task that might take a human adjuster an hour or more. This allows a single adjuster to manage and process a vastly greater number of claims per day, significantly accelerating the entire claims lifecycle and getting funds to policyholders faster when they need it most.

Equally important is the enhancement of safety and accessibility. Drones eliminate the need for adjusters to climb onto steep, unstable, or damaged roofs, work at heights, or enter structurally compromised buildings. They can safely assess damage from events like chemical spills, floods, or fires where it may be unsafe for humans to enter for extended periods. Furthermore, drones provide access to previously challenging locations, such as tall commercial buildings, industrial facilities, or properties in remote areas.

The data-driven nature of drone-based assessments leads to unparalleled accuracy and consistency. The detailed imagery and models create an immutable, objective record of the loss at a specific point in time. This record is invaluable for justifying claim decisions, resolving disputes, and preventing fraud. It provides transparent evidence that can be easily shared with the policyholder, contractors, and reinsurers, fostering trust and streamlining communication across all stakeholders.

On a macro level, the aggregated data collected from thousands of claims is becoming a strategic asset for insurers. By analyzing trends across a portfolio, carriers can gain deeper insights into risk factors, material performance, and the specific vulnerabilities of different building types to various perils. This wealth of information empowers them to refine their underwriting models, price policies more accurately, and even develop new, innovative insurance products tailored to emerging risks.

Despite the clear advantages, the widespread adoption of drone technology in insurance is not without its challenges. Regulatory hurdles, particularly around beyond-visual-line-of-sight (BVLOS) operations and flying in controlled airspace, remain significant in many regions. There are also ongoing concerns regarding data privacy, as drones can capture imagery of neighboring properties. Furthermore, the industry faces a skills gap, needing to train traditional adjusters to become proficient data analysts and drone operators or to integrate new tech-savvy talent into their teams.

Looking ahead, the future of drone-based insurance adjusting is poised for even greater innovation. The integration of drones with other technologies like the Internet of Things (IoT) and real-time data streams is on the horizon. We can envision a future where a drone dispatched after a storm automatically verifies IoT sensor data from a home, provides a instant damage assessment, and triggers an immediate preliminary payment to the policyholder. The evolution towards fully automated flight planning, data capture, and analysis will further reduce human intervention, making the process even faster and more efficient.

In conclusion, the marriage of drone and remote sensing technology is far more than a convenient new tool; it is fundamentally restructuring the core processes of property insurance. It is replacing subjective, ground-based, and laborious methods with an objective, aerial, and data-rich approach. This transformation is delivering tangible benefits: enhanced safety, unprecedented efficiency, greater accuracy, and faster financial recovery for those suffering a loss. As the technology continues to mature and integrate deeper into insurance workflows, it will undoubtedly become the new standard, cementing its role as the eyes in the skies that are helping to restore stability on the ground.

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By Grace Cox/Nov 12, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025