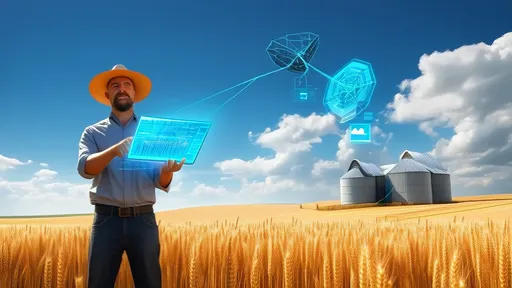

In the vast, sun-scorched fields of the American Midwest, a quiet revolution is taking root. For generations, farmers have battled the elements, their livelihoods hanging in the precarious balance of rain and drought, hail and heat. Traditional crop insurance, while a critical safety net, has often been a source of frustration—a slow, paperwork-laden process requiring adjusters to survey damage, a task both time-consuming and subjective. But a new paradigm is emerging from the skies, leveraging the cold, precise gaze of satellites to transform risk management in agriculture. This is the era of parametric insurance, a data-driven approach that promises not just to indemnify loss, but to redefine resilience itself.

At its core, parametric insurance, or index-based insurance, is a radical departure from conventional indemnity models. Instead of compensating for a measured loss, it pays out based on the triggering of a predefined parameter or index. If a specific, objective threshold is breached—say, rainfall drops below 50 millimeters in a defined period, or soil moisture readings from a satellite dip to a certain level—the policy automatically pays a predetermined sum. The beauty of this system lies in its simplicity and objectivity. There are no lengthy claims assessments, no disputes over the value of damaged crops, and no moral hazard where a farmer might be incentivized to neglect their fields. The contract is based purely on verifiable data.

The engine powering this agricultural revolution is Earth observation technology. A constellation of satellites, equipped with advanced multispectral and hyperspectral sensors, continuously monitors our planet. These sophisticated instruments measure far more than just visual images; they capture data on vegetation health (through indices like NDVI - Normalized Difference Vegetation Index), soil moisture content, land surface temperature, and precipitation levels. This torrent of raw data is then fed into complex algorithms and weather models, distilling chaotic environmental information into clean, actionable indices. For a parametric drought insurance policy, the index isn't a farmer's subjective report of dry conditions; it is a precise, geolocated reading of water stress in the soil, observable from hundreds of miles above the Earth.

The implications for the agricultural sector are profound. Speed is the most immediate benefit. In the wake of a catastrophic drought or a devastating hailstorm, a traditional insurance claim can take months to settle. For a farming family operating on razor-thin margins, this delay can be catastrophic, potentially forcing them into debt or out of business altogether. A parametric policy, by contrast, can trigger a payout within days or even hours of the qualifying event. This rapid injection of capital allows farmers to cover immediate expenses, purchase seeds for the next planting season, and stay afloat without the debilitating wait. It functions less like a reimbursement and more like an instantaneous emergency fund, activated by the environment itself.

Furthermore, parametric insurance opens the door to coverage for previously uninsurable risks. Traditional models struggle with pervasive risks like drought, where damage is gradual and spread over a wide area, making it difficult for an adjuster to attribute specific yield losses to the weather event alone. Parametric contracts sidestep this entirely. By tying the payout to an objective weather station or satellite reading that correlates highly with agricultural loss, insurers can confidently offer protection against these systemic perils. This is a game-changer for farmers in developing countries and arid regions, who have historically been most vulnerable to climate shocks and least served by traditional insurance markets.

However, the model is not without its challenges. The chief concern is what is known as basis risk. This is the risk that the parametric trigger does not perfectly match the actual loss experienced by the farmer. For example, a satellite might indicate sufficient rainfall across a large area, but a specific farm might have missed the showers due to highly localized weather patterns, leaving the farmer with a loss but no payout. Conversely, the index could be triggered, granting a payout to all farmers in the region, even though some may not have suffered significant damage. Mitigating basis risk requires increasingly granular data, sophisticated modeling to ensure the index closely correlates with actual farm yields, and clear communication so farmers fully understand the product they are purchasing.

Despite these challenges, the trajectory is clear. The convergence of big data analytics, the plummeting cost of satellite technology, and the increasing urgency of climate change adaptation are fueling rapid adoption. Major reinsurers and agribusiness corporations are investing heavily in developing more precise indices and distributing these products through mobile platforms, making them accessible even to smallholder farmers with a simple mobile phone. The potential extends beyond drought to cover frost, flood, excessive heat, and even pest infestation, with satellites capable of detecting subtle changes in plant health long before the human eye can see them.

Looking forward, parametric insurance is more than a financial product; it is a critical component of climate resilience. As weather patterns become more volatile and extreme, the ability to quickly and automatically mobilize capital to where it is needed most will be paramount. It represents a shift from reactive recovery to proactive preparedness, enabling farmers to make strategic decisions with greater confidence. The marriage of finance and technology, watching over the fields from space, is sowing the seeds for a more secure and sustainable future for global agriculture, ensuring that those who feed the world are not left to face the storms alone.

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By Grace Cox/Nov 12, 2025

By /Aug 30, 2025

By /Aug 30, 2025

By /Aug 30, 2025